Event Summary: European Hotel Market Webinar

We recently gathered a panel of European experts to review the state of the hotel market and key trends over the past 12 months, including the investment landscape, ESG, operators and brands, and opportunities in Europe. With the worst of the pandemic now hopefully behind us, the panel considered whether Covid has influenced short-term or long-term change across the market.

Business. Built around You.

Your expert business property advisers

Moderated by Lukas Hochedlinger, Managing Director – Central & Northern Europe, Christie & Co, the panel also featured:

- Andreas Löcher, Head of Investment Management Hospitality, Union Investment

- Matthieu Dracs, Asset Manager – Deputy Managing Director, Extendam

- Jerome Briet, Chief Development Officer (EMEA), Marriott International

- Daniel Roger, Managing Director, Fattal Hotels Europe & UK

- Carine Bonnejean, Managing Director – Hotels, Christie & Co

THE STATE OF OPERATIONS, CONTRACTS & BRANDS

Hardly a week goes by without the creation of a new hotel brand from one of the global hospitality groups, and with so many now operating in the market, finding the right one seems complicated. With this in mind, Lukas Hochedlinger kicked off the discussion by asking the group about their considerations when establishing an operating model and building an investment strategy post-Covid.

Andreas Löcher, Head of Investment Management Hospitality, Union Investment highlighted that brands can be expensive to operate, so the strength of the covenant of the tenant needs to be a key focus when evaluating a brand, particularly following the pandemic. The type of market you’re looking to operate in is also a key factor.

The range of economic and operational challenges currently facing hoteliers, including inflation and rising energy and payroll costs, will certainly impact profitability in 2022. Jerome Briet, Chief Development Officer (EMEA), Marriott International noted that hoteliers have been able to balance this until now, with guests happy to accept reduced services. However, the easing of international travel restrictions is seeing travel return at pace and guests will be expecting normal levels of service once again, which will place increased pressure on operator margins.

Matthieu Dracs, Asset Manager – Deputy Managing Director, Extendam added that Groups will have to look at new ways to be profitable, such as converting buildings into mixed use hotels, but will not be able to manage without the staff. Businesses will have to change their mindset and investment targets and strategies to have a broader vision of the investment and be more active and agile. They must look at what is necessary for the industry, such as mixed-use spaces such as lobbies as a way to increase profitability.

Often when there is a crisis there is talk of the end of the fixed lease. Lukas Hochedlinger asked the group whether management agreements or fully variable leases ever be the fully dominant contractual model in Europe? Nearly all panellists said no, however Daniel Roger, Managing Director, Fattal Hotels Europe & UK, highlighted that it will depend on the banks who finance the projects and if they won’t support management agreements then that will be the reality. Daniel added that they prefer hybrid leases and are concentrating on purchasing hotels.

INVESTMENT

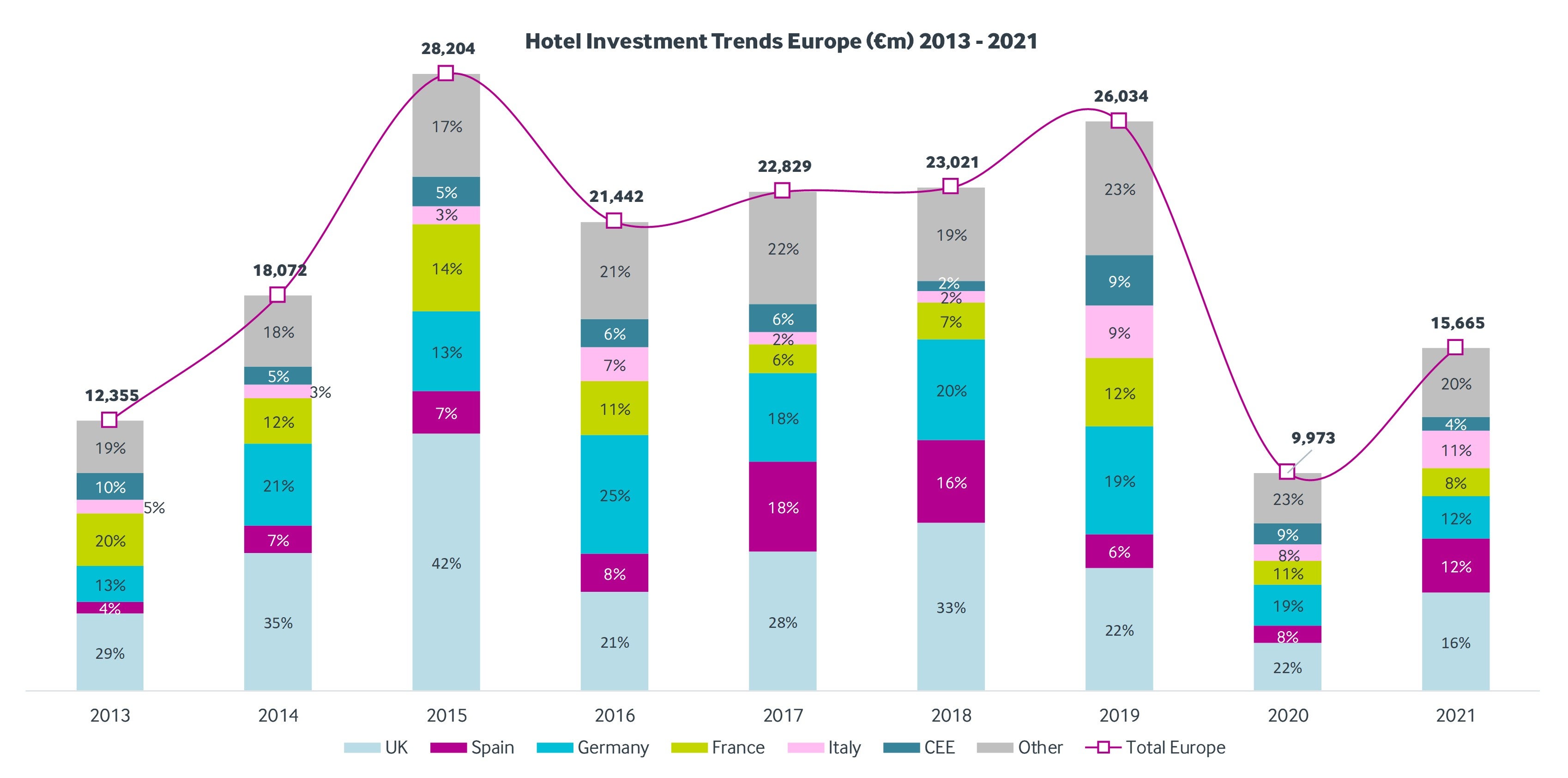

Between 2015-2018, we saw investment levels at around 20bn EUR and even more than 25bnEUR in 2019 but this plummeted to less than 10bnEUR in 2020, recovering somewhat in 2021.

Notes: As of 23 March 2022; Includes transactions €5 million and greater Sources: Real Capital Analytics www.rcaanalytics.com, Christie & Co Research and Analysis

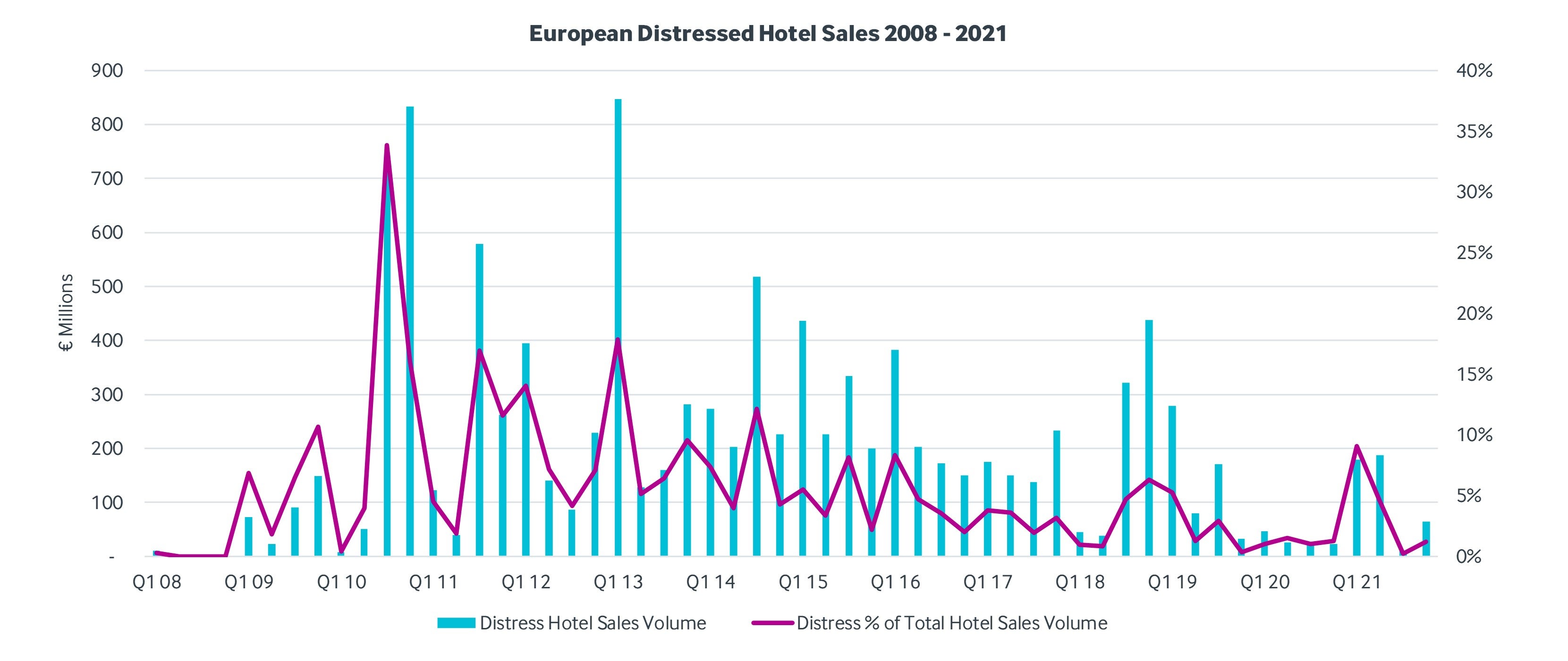

Little stock has been put on market and there has been very low levels of distressed sales over the past two years, potentially due to government support. Carine Bonnejean noted that in 2021, only 2.5% of European hotel deal volume was distressed, compared to 1.2% in 2020. This is also very far away from the 15.8% of 2010.

Notes: As of 24 March 2022; Sources: Real Capital Analytics www.rcaanalytics.com, Christie & Co Research and Analysis

Investors are looking for off-market distressed opportunities with a value-add angle at reasonable prices but there are no bargains to be found right now, with prices holding up well.

So, will we see more distress this year? Ultimately, it will depend on the banks decision to make moves that will create more distress. Debt will need to be refinanced and deferred rents will, at some point, have to be paid back. In addition, interest rates are rising and hoteliers are also facing increased operating costs. Despite this, the general consensus is that we will not see the flood of distress that was first anticipated at the onset of the pandemic.

Matthieu Dracs said that there are still fewer opportunities up for sale as many owners were able to keep hold of their hotel asset due to government support. We have all been waiting for distressed opportunities for the last two years, which is good because we had to preserve our economy. The wave of distress may come in a few years, but we don’t know for certain. The assets that are for sale are available at pre-pandemic prices, especially in good locations such as gateway locations and international cities, despite the lack of international visitors for the last two years. But in locations with significant numbers of domestic customers there is a good outlook for the year ahead. We are looking for good, resilient assets. With regards to financing, we may see issues with the banks and rising interest rates, however the investment markets will not collapse.

LEISURE & RESORT MARKETS ARE ON THE RISE

With Covid turning everything we thought we knew upside down, we observed investors’ appetite shifting from large corporate hotels in European gateway cities, with primarily international/overseas guests, to resort destinations with easy accessibility and high share of domestic guests. There is a strong ‘revenge travel’ mindset amongst leisure travellers, whilst business travel will be slower to recover.

Daniel Roger added that Fattal Hotels will continue to look at opportunities in leisure markets, as well as major cities. Costs will rise for operators in terms of staffing, energy etc, but people will not give up holidays or travel.

Andreas Löcher commented that now is the time to move into resort hotels, as it is a resilient market, especially coming out of the pandemic with people keen to travel. We may see some consolidation of smaller hotels as the next generation of owners move out of the industry, but this shift provides good opportunities for investors.

ESG

Post-pandemic, ESG is coming to the fore, but how important is this? Carine discussed how investors are now asking whether an opportunity is ESG compliant, often before asking the price. However, few are, and this is going to be a key issue over the next few years and will have a big impact on pricing. Many don’t understand the implication and the significant capex that will be required, and this is a subject we, as an industry, need to be more aware of. We may see issues in the independent market over the next few years as a result.

ESG is an increasingly important consideration for institutional investors and brands, as evidenced by Jerome Briet, Chief Development Officer (EMEA), Marriott International, who shared the brands’ vision for significant change by 2025. A lot is being done in the industry, with companies joining certain initiatives and introducing systems within their hotels to reduce water usage and carbon emissions. Newer hotels must have a sustainability rating, but it will be tougher to update the iconic hotels, if the local regulations become more stringent then the capex required will be extensive. Real estate will never be the perfect green investment but there are meaningful ways to change hotel portfolios to improve their ratings. We should also focus on diversity and human rights which are incorporated into ESG.

View the full webinar below.